Understand Your Cost Share in Medicare

When you have Medicare, the cost of your healthcare is shared between you and your plan. This is called **cost sharing**. While the term might sound complicated, it simply means the part of your medical bills that you pay yourself, while Medicare covers the rest.

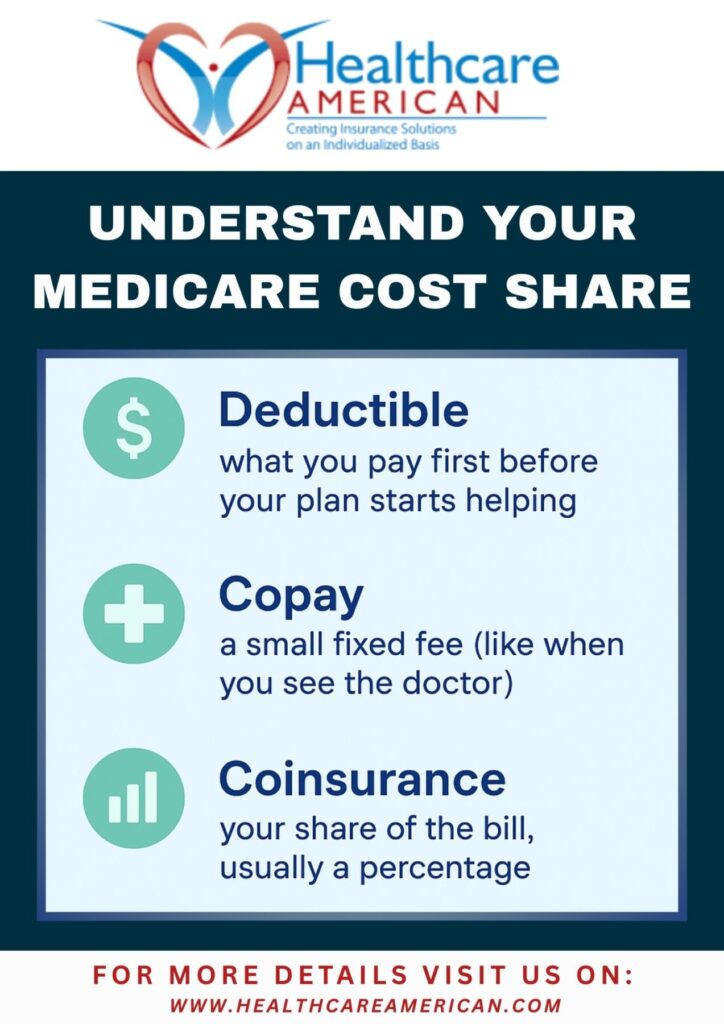

Cost sharing is made up of three main parts: your **deductible, copay, and coinsurance**. Understanding these terms can help you plan ahead, avoid surprises, and feel more confident about your Medicare coverage. Let’s take a closer look.

—

Deductible

A **deductible** is the amount you must pay first before Medicare begins helping with the cost of your care.

➡️ **Example:** If your Part B deductible is \$240 for the year, you must pay that amount out of pocket before Medicare starts paying its share.

—

Copay

A **copay** is a fixed amount you pay each time you receive care or pick up a prescription.

➡️ **Example:** You might pay \$20 for a doctor’s visit or \$10 when you pick up medicine.

—

Coinsurance

**Coinsurance** is when you and Medicare split the cost of a service by percentage.

➡️ **Example:** If a covered service costs \$100 and your coinsurance is 20%, you pay \$20 and Medicare pays \$80.

—

Putting It All Together: Cost Sharing

Your **cost share** is the total of all these expenses—deductible, copays, and coinsurance.

➡️ **Example of cost sharing in action:**

1. You pay your deductible first.

2. Then, you may pay a copay for a doctor visit.

3. If you need a bigger procedure, you may pay coinsurance (like 20% of the bill).

—

Help Paying for Medicare Costs

The good news is that if you are on a limited income, there are programs that can help cover some or even most of your Medicare cost sharing. In Maryland, you may qualify for:

* QMB (Qualified Medicare Beneficiary Program):Pays for Part A and B premiums, deductibles, and coinsurance. With QMB, you pay very little out of pocket for covered care.

These programs are designed to make Medicare more affordable. Even if you think your income might be too high, it’s worth checking—you may still qualify.

—

Why This Matters

Many people with Medicare live on a fixed income. By understanding your cost share—and knowing about programs that can help—you can better plan for healthcare costs and avoid unexpected bills.

—

Final Thoughts

Your **cost share** is simply your part of the medical bill, made up of deductibles, copays, and coinsurance. But remember, you may not have to carry this burden alone. Programs like QMB, SLMB, LIS, and Maryland’s SPDAP can provide real financial relief.

👉 If you live in Maryland and want to know if you qualify for these programs, our team can guide you step by step. We’ll review your plan, check for savings, and make sure you’re getting all the help available to you.

👉 Need guidance or have questions about your Medicare coverage? Contact us today at healthcareamerican.com or call 443-929-0433 for personal assistance.

👉 Ready to explore your Medicare options? Contact us today for a free consultation.