Enrolling in Medicare can feel overwhelming. With all the different parts, plans, and deadlines, it’s easy to make a wrong move that could cost you money or limit your healthcare choices. The good news? With the right information, you can avoid the most common pitfalls.

Here are the top 5 mistakes people make during Medicare enrollment — and how you can avoid them.

1. Missing Your Initial Enrollment Period

Your Initial Enrollment Period (IEP) starts three months before you turn 65, includes your birthday month, and ends three months after. If you miss it, you could face:

- Late enrollment penalties on Part B (medical insurance) and Part D (prescription drug coverage).

- Gaps in coverage until the next enrollment window.

👉 How to avoid it: Mark your calendar well before your 65th birthday. If you’re still working and have employer coverage, talk with a Medicare professional about whether you should enroll right away or delay without penalty.

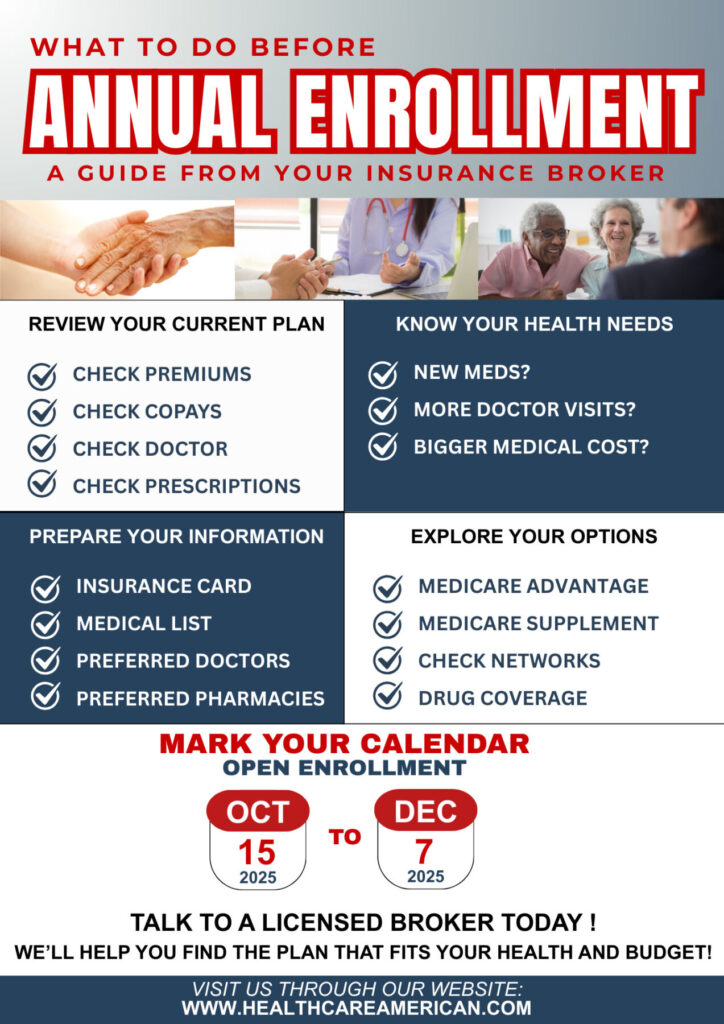

2. Not Comparing All of Your Options

Many people sign up for the first plan they see or stick with what a friend or neighbor has. But everyone’s needs are different.

- Medicare Advantage (Part C) plans can offer extra benefits like dental, vision, and fitness perks.

- Medigap Supplement Plans help cover out-of-pocket costs that Original Medicare doesn’t.

👉 How to avoid it: Review your health, prescriptions, and budget each year. A plan that’s perfect for one person may be costly or limiting for someone else.

3. Ignoring Prescription Drug Coverage

Even if you don’t take medications now, skipping Part D prescription coverage can be a big mistake. If you decide to add it later, you’ll likely face a lifetime penalty added to your monthly premium.

👉 How to avoid it: Enroll in at least a basic Part D plan when you first become eligible, so you’re protected for the future.

4. Overlooking Provider Networks and Coverage Rules

Not all doctors, hospitals, or pharmacies participate in every plan. Some Medicare Advantage plans restrict you to in-network providers or require referrals. Choosing a plan without checking can leave you with higher bills or fewer choices.

👉 How to avoid it: Make a list of your doctors, preferred hospital, and medications. Confirm that they’re covered before you enroll in a plan.

5. Forgetting to Review Your Plan Every Year

Your health needs — and the plans available in your area — can change annually. Premiums, deductibles, and drug formularies may shift from year to year. Too many people let their plan automatically renew without checking if it’s still the best fit.

👉 How to avoid it: During the Annual Enrollment Period (AEP), October 15 – December 7, review your plan and compare your options. A quick check could save you hundreds of dollars.

Final Thoughts

Medicare is not one-size-fits-all. By planning ahead, reviewing your options, and getting guidance from a licensed Medicare advisor, you can avoid these costly mistakes.

👉 At Healthcare American, we help you make sense of your options in plain English so you can choose the plan that fits your health and budget.

📞 Call us today at 443-929-0433 to schedule your free consultation.

👉 Ready to explore your Medicare options? Contact us today for a free consultation.