Introduction

Turning 65 is an important milestone — and one of the biggest decisions you’ll face is how to set up your Medicare coverage. With all the jargon and endless options, it’s easy to feel overwhelmed. The good news? Once you understand the basics of Medicare Advantage and Medicare Supplement (Medigap) plans, you’ll be well on your way to choosing the coverage that fits your health needs and budget.

At Healthcare American, we believe in breaking down the complexity so you can make a confident decision.

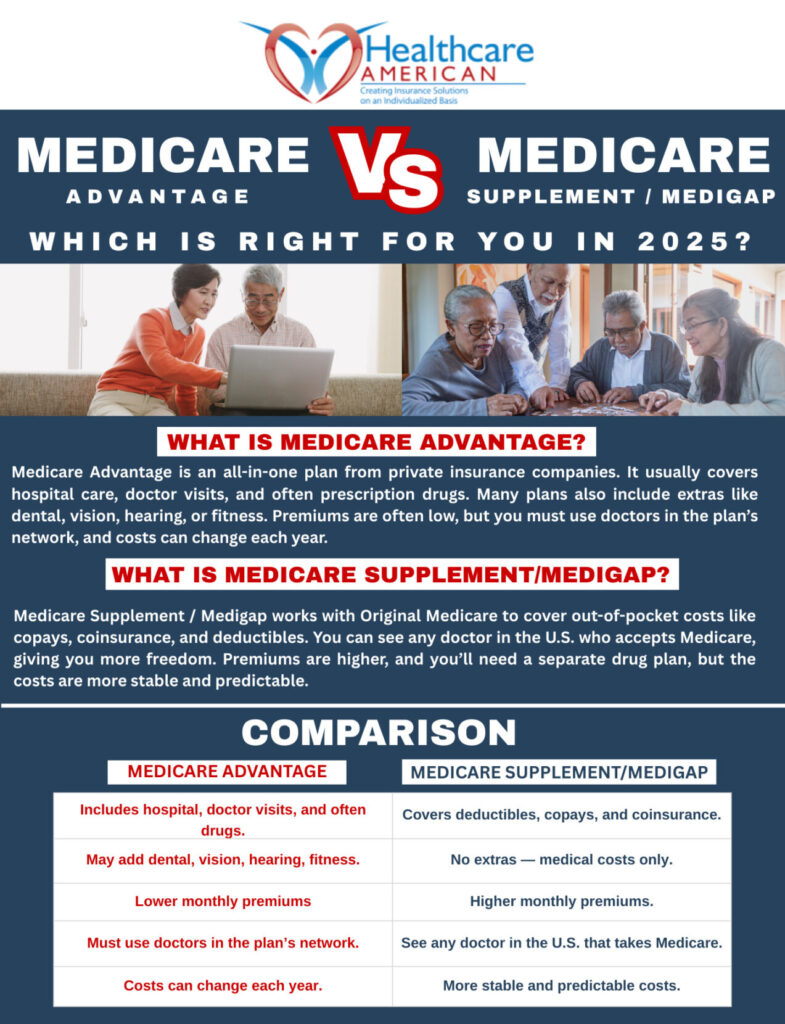

What Is Medicare Advantage? (Part C)

Medicare Advantage plans are an “all-in-one” alternative to Original Medicare, offered by private insurance companies approved by Medicare.

Key Features:

- Covers Part A (hospital) and Part B (medical) services.

- Often includes Part D (prescription drugs).

- Many offer extra benefits such as dental, vision, hearing, or fitness memberships.

- Usually requires using doctors and hospitals in a network.

Pros:

- Low or even $0 monthly premiums (beyond your Part B premium).

- Convenience of bundling coverage in one plan.

- Extra benefits Original Medicare doesn’t provide.

Cons:

- Must use in-network providers for full benefits.

- Out-of-pocket costs can vary year to year.

- Prior authorization may be required for some services.

What Is a Medicare Supplement (Medigap) Plan?

Medigap plans work alongside Original Medicare to help cover the costs that Medicare leaves behind — like copayments, coinsurance, and deductibles.

Key Features:

- Freedom to see any doctor or hospital in the U.S. that accepts Medicare.

- Provides predictable costs with fewer surprise bills.

- Plans are standardized (Plan G, Plan N, etc.), so you know exactly what you’re buying.

Pros:

- Broadest provider access — no restrictive networks.

- Excellent for frequent travelers within the U.S.

- More predictable out-of-pocket costs.

Cons:

- Monthly premiums are higher than most Advantage plans.

- Prescription drug coverage (Part D) must be purchased separately.

- Doesn’t include “extras” like dental or vision unless you buy separate policies.

Medicare Advantage vs. Medigap: Side-by-Side Comparison

| Feature | Medicare Advantage (Part C) | Medigap (Supplement) |

|---|---|---|

| Premiums | Often low ($0–$50/month) | Higher ($100–$200+/month) |

| Provider Choice | Must use plan’s network | Any Medicare-accepting doctor |

| Prescription Drugs | Often included | Separate Part D needed |

| Extra Benefits | Dental, vision, fitness | Not included |

| Out-of-Pocket Costs | Varies by service | Very predictable |

| Best Fit For | Budget-conscious, want bundled benefits | Frequent travelers, want provider freedom |

How to Decide Which Is Best for You

Choosing between Medicare Advantage and Medigap depends on your priorities:

- Budget: If keeping monthly costs low is most important, Medicare Advantage may fit better.

- Provider Choice: If seeing your favorite doctors or having nationwide flexibility matters, Medigap might be worth the higher premium.

- Health Needs: If you anticipate higher medical costs, Medigap’s predictability could save you money in the long run.

Final Thoughts

There’s no one-size-fits-all answer — the right plan depends on your health, lifestyle, and financial goals. At Healthcare American, we compare plans across multiple carriers, explain your options in plain English, and help you avoid costly mistakes.